This article describes in a simplified way how Coverflex Wallet works and our recommendation for the accounting treatment of Coverflex benefits. The recommendations presented should not, however, be interpreted as binding. For more detailed information, please check the Accountant's Manual.

Summary:

How does Coverflex Wallet work?

When the company loads the employee's Wallet, it can load two different balances: the meal balance and/or the benefits balance. While the meal balance must be mentioned in the payroll, the amount charged to benefits is a virtual allocation of the company's Wallet balance and should only be considered in salary processing when used by the employee. In practice, when an employee uses a flexible benefit, the company will have the information available in the reports available on the platform and will make the salary processing framework in accordance with the tax framework of each benefit.

How should the payroll be processed?

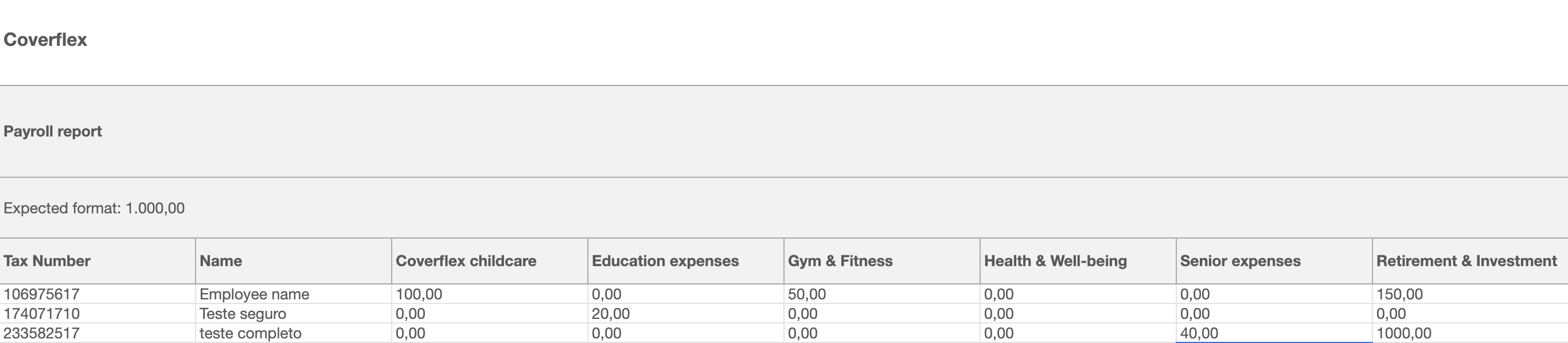

The payroll must be processed after consulting the payroll report that contains the expenses of each employee by benefit category in the selected period. The report is available on the company's dashboard at Wallet > Reports > Payroll report.

There are three main categories of benefits. The first category relates to business expenses, where employees must submit an invoice with the company's tax information. These expenses are exempt from IRS and Social Security. The second category is the one of personal expenses, which is exempt from Social Security. The third category is the one regarding childcare vouchers, which are exempt from IRS and Social Security. In Coverflex Wallet, the childcare vouchers are issued by the employee. The invoice is issued in the name of the company and made available in the accounting report.

You can get more information about our understanding of the tax framework by consulting our Accountant's Manual; however, internal advice from an accountant is always recommended.

What kind of information should I provide to accounting?

The accounting report contains all the necessary documents (invoices, equivalent documents and proof of payment of meal allowance, list of benefits and/or professional expenses used in a certain period, company account balances and employee benefits Wallet) and is available on the company dashboard in Wallet > Reports > Report for accounting.